The first thing that will be checked by lenders is your credit score whenever you apply for a loan. Your good credit score will help to approve the loan. The credit score is generated based on your credit reports history. You should know about your credit score and its importance.

What is credit score?

Credit score helps the lender to make decisions easily whether the loan could be approved or not in the initial stage. Credit scores make sense about the behavior of the borrower. Banks wanted to know about your past history whether you have taken any loan or not, about the repayments etc. It makes them understandable about the risk factors and whether you could repay the loan or not.

All information is centralized and within a few minutes by digging credit history, lenders can get an initial idea about creditworthiness of the applicant’s.

Credit scores helps applicants also by identifying the status and makes them eligible for the loan that is hasslefree. This is the first judgment about you that lenders could allot quickly.

How many types of credit score?

Most people refer to FICO credit scores, but you may have a different FICO score for each of three major credit bureaus like Equifax, Experian, and TransUnion. FICO score is the most popular score used for any type of loan.

What credit score you are using is not a matter, it only gives an idea ab0out you whether you can repay the loan.

FICS credit score analyzes about your debt, payment history from your past report. The standard score is above 750, it may vary based on types of loan and other facts.

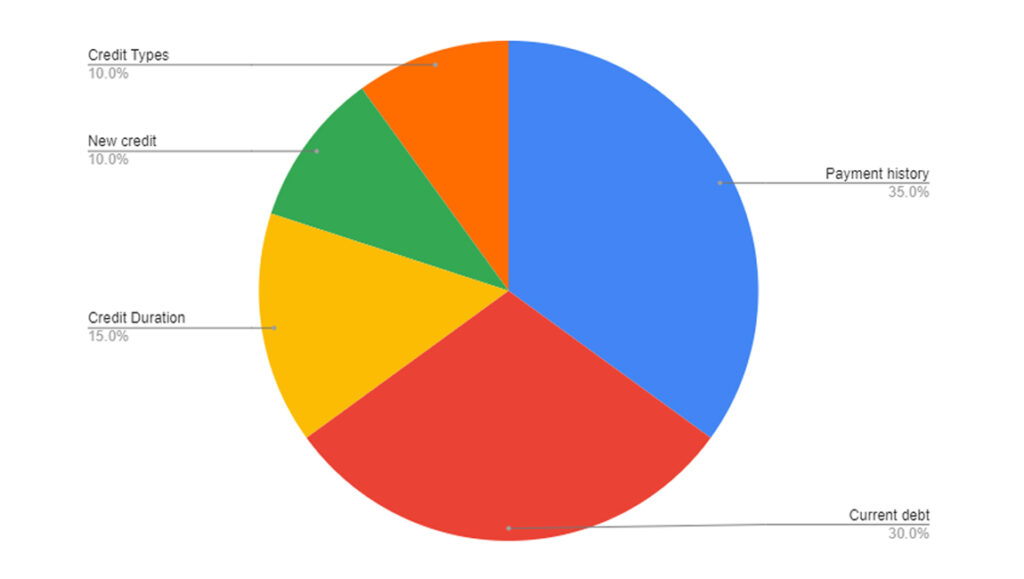

How is the credit score calculated?

- Payment history: 35%. This depends on your regular payments/EMI or defaults to pay loan.

- Current debt: 30%. Based on the loan amount and how much you already covered.

- Credit duration: 15%. Based on the length of the credit and history of borrowing and paying back?

- New credit: 10%. In case you have applied for the loan recently, maybe it’s your first time.?

- Credit types: 10%. Depends on the mixed type of loans like auto, home, credit cards, and others?

New applicants do not have any credit history, they didn’t take any loan. For them the other sources could be considered like house rent, utility bills etc.